While the current low interest environment is great for mortgages and other debts we may hold, it can mean something different for our retirement savings. Now is the time to consider selecting a Fixed Indexed Annuity (FIA) as one of your plans’ allocation options.

A Fixed Indexed Annuity (FIA) is an insurance product designed to accumulate money for retirement. It offers guarantees against loss of what’s in the account (the premiums you have paid, and the interest earned) due to a decline in the index*.

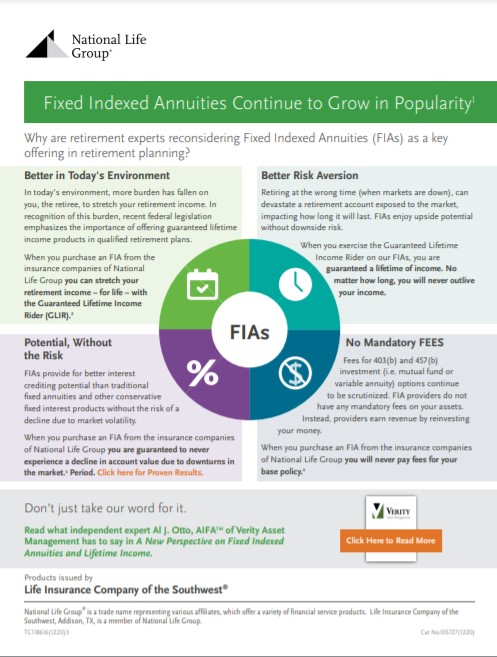

So, why should you consider adding a fixed indexed annuity to your plan?

- There is more growth potential than a traditional fixed annuity. Interest is credited based in-part on the change of a market index, such as the S&P 500**. This means you reap some of the benefits of an up market, but never lose value in a down market due to a decline in the index since you are not directly participating in any stock or equity investments.

- It provides downside protection. With increased market volatility, it’s critical to ensure your retirement savings are protected when the market index is down. FIAs are structured so you will never earn less than 0% interest in the index strategy due to an index decline.

- An FIA can guarantee you a lifetime stream of income during retirement, supplementing your pension and helping you live the retirement of your dreams. Are you one of the 95% of people interested in owning an annuity that provides a guaranteed income each month***?

For more information on retirement planning, visit Retirement Homeroom.

And for more details on Fixed Indexed Annuities, visit A New Perspective on Fixed Index Annuities and Lifetime Income complete white paper from Verity Asset Management.

Or scan this 1-page summary of

A New Perspective on Fixed Index Annuities and Lifetime Income.

Footnotes and Resources

*Assuming no withdrawals during the withdrawal charge period. Rider charges continue to be deduced regardless of whether interest is credited. Guarantees are dependent on the claims paying ability of the issuing company.

** Standard & Poor’s®, “S&P®, S&P 500®, and Standard & Poor’s 500™ are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. This Product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representations regarding the advisability of investing in the product. The S&P Composite Index of 500 stocks (S&P 500®) is a group of unmanaged securities widely regarded by investors to be representative of large company stocks in general. An investment cannot be made directly into an index.

*** Insured Retirement Institute, https://www.fa-mag.com/news/iri-study–most-consumers-want-guaranteed-lifetime-income-54272.html, Feb. 2020.

Annuities have surrender chargers that are assessed during the early years of the contract if the contract owner surrenders the annuity. In addition, withdrawals prior to age fifty-nine and a half may be subject to a 10% Federal Tax Penalty. Indexed annuities do not directly participate in any stock or equity investments. Guaranteed lifetime income may be provided either by annuitizing an annuity, or through an annuity income rider. Riders are supplemental benefits that can be added to an annuity. Riders are optional, may require additional premium and may not be available in all states or on all products. This is not a solicitation of any specific annuity.

TC118682(1220)3