Learn about the five interest crediting strategies we offer!

Fixed indexed annuities (FIAs) are products meant for long-term accumulation that provide policyholders the ability to participate in market gains while providing downside protection¹. In this article, we’ll explore how index crediting works and its benefits.

FIAs typically link their interest crediting to a market index and have a fixed rate option. At National Life Group, we offer six interest crediting strategies:

- Declared Crediting

- S&P 500® Index

- S&P 500® Performance Trigger

- S&P 500® Monthly Sum Cap

- US Fundamental Balanced Index

- Global Balanced Index

What is a Cap and Participation Rate:

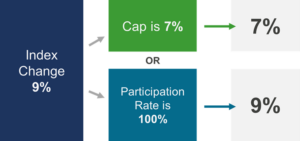

An index uses either a cap or a participation rate to determine interest credited.

A Cap is the maximum amount of interest that will be credited to a strategy.

A Participation Rate is the percentage of the change of the index that you will participate in when calculating the interest that will be earned.

Let’s look at an example of a Point-to-Point calculation.

Why a Fixed Index Annuity:

Potential: When the selected index experiences positive growth over a specific period (e.g., one or two years), interest is credited to the client’s policy.

Protection: FIAs include a protective feature called the “floor.” The floor ensures that when the index declines, the annuity contract won’t lose value. Zero becomes the minimum interest credited.2

Another valuable feature is the reset. Each crediting period, the annuity “resets” to a new starting point. This means that gains from previous years are locked in, even if subsequent years have negative performance.

The following chart illustrates when the S&P 500 Index is positive the FIA (green line) moves up. Conversely, when the S&P 500 Index is flat or negative, the FIA moves sideways.

For anyone looking to potentially earn higher rates than what a traditional savings account or money market can earn but not comfortable with the risk associated with the market, fixed indexed annuities are a potential solution!

For more information, contact your local Agent or National Life Group.

1. Indexed annuities do not directly participate in any stock or equity investments.

“Standard & Poor’s®”, “S&P®”, “S&P 500®”, and “Standard & Poor’s 500™” are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. This Product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representations regarding the advisability of investing in the Product. The S&P Composite Index of 500 stocks (S&P 500®) is a group of unmanaged securities widely regarded by investors to be representative of large company stocks in general. An investment cannot be made directly into an index.

The Global Balanced SG Index (the “Index”) is the exclusive property of SG Americas Securities, LLC (SG Americas Securities, LLC, together with its affiliates, “SG”). SG has contracted with [S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC] (“S&P”) to maintain and calculate the Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “Global Balanced SG Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. SG has licensed use of the SG Marks to Life Insurance Company of the Southwest (“LICS”) for use in a fixed indexed annuity offered by LICS (the “Fixed Indexed Annuity”). SG’s sole contractual relationship with LICS is to license the Index and the SG Marks to LICS. None of SG, S&P, or other third party licensor (collectively, the “Index Parties”) to SG is acting, or has been authorized to act, as an agent of LICS or has in any way sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Fixed Indexed Annuity or provided investment advice to LICS. No Index Party has passed on the legality or suitability of, or the accuracy or adequacy of the descriptions and disclosures relating to, the Fixed Indexed Annuity, including those disclosures with respect to the Index. The Index Parties make no representation whatsoever, whether express or implied, as to the advisability of purchasing, selling or holding any product linked to the Index, including the Fixed Indexed Annuity, or the ability of the Index to meet its stated objectives, including meeting its target volatility. The Index Parties have no obligation to, and will not, take the needs of LICS or any annuitant into consideration in determining, composing or calculating the Index. The selection of the Index as a crediting option under a Fixed Indexed Annuity does not obligate LICS or SG to invest annuity payments in the components of the Index. THE INDEX PARTIES MAKE NO REPRESENTATION OR WARRANTY WHATSOEVER, WHETHER EXPRESS OR IMPLIED, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, THOSE OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE), WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN OR RELATING THERETO, AND IN PARTICULAR DISCLAIM ANY GUARANTEE OR WARRANTY EITHER AS TO THE QUALITY, ACCURACY, TIMELINESS AND/OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN, THE RESULTS OBTAINED FROM THE USE OF THE INDEX AND/OR THE CALCULATION OR COMPOSITION OF THE INDEX, OR CALCULATIONS MADE WITH RESPECT TO ANY FIXED INDEXED ANNUITY AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE OR OTHERWISE. THE INDEX PARTIES SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR OR OMISSION IN THE INDEX OR IN THE CALCULATION OF THE INDEX, AND THE INDEX PARTIES ARE UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN, OR FOR ANY INTERRUPTION IN THE CALCULATION OF THE INDEX. NO INDEX PARTY SHALL HAVE ANY LIABILITY TO ANY PARTY FOR ANY ACT OR FAILURE TO ACT BY THE INDEX PARTIES IN CONNECTION WITH THE DETERMINATION, ADJUSTMENT OR MAINTENANCE OF THE INDEX. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL AN INDEX PARTY HAVE ANY LIABILITY FOR ANY DIRECT DAMAGES, LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. No Index Party is a fiduciary or agent of any purchaser, seller or holder of a Fixed Indexed Annuity. None of SG, S&P, or any third party licensor shall have any liability with respect to the Fixed Indexed Annuity in which an interest crediting option is based is on the Index, nor for any loss relating to the Fixed Indexed Annuity, whether arising directly or indirectly from the use of the Index, its methodology, any SG Mark or otherwise. Obligations to make payments under the Fixed Indexed Annuities are solely the obligation of LICS. In calculating the performance of the Index, SG deducts a maintenance fee of 0.50% per annum on the level of the Index, and fixed transaction and replication costs, each calculated and deducted on a daily basis. The transaction and replication costs cover, among other things, rebalancing and replication costs. The total amount of transaction and replication costs is not predictable and will depend on a number of factors, including the leverage of the Index, which may be as high as 200%, the performance of the indexes underlying the Index, market conditions and the changes in the market states, among other factors. The transaction and replication costs, which are increased by the Index’s leverage, and the maintenance fee will reduce the potential positive change in the Index and increase the potential negative change in the Index. While the volatility control applied by the Index may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls.

The PIMCO US Fundamental Balanced Index (the “Index”) is a trademark of Pacific Investment Management Company LLC (“PIMCO”) and has been licensed for use for certain purposes by National Life Insurance Company (the “Company”) with respect to this annuity (“the Product”). The Index is the exclusive property of PIMCO and is made and compiled without regard to the needs, including, but not limited to, the suitability, appropriateness or needs, as applicable, of the Company, the Product, or any Product owners. The Product is not sold, sponsored, endorsed or promoted by PIMCO or any other party involved in, or related to, making or compiling the Index. It is not possible to directly invest in the Index. PIMCO does not make any warranty or representation as to the accuracy, completeness, or availability of the Index or information included in the Index and shall have no responsibility or liability for the impact of any inaccuracy, incompleteness, or unavailability of the Index or such information. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index makes any representation or warranty, express or implied, to the Product owner, the Company, or any member of the public regarding the advisability of purchasing annuities generally or the Product particularly, the legality of the Product under applicable federal or state securities, state insurance and any tax laws, the ability of the Product to track the performance of the Index, any other index or benchmark or general fixed income market or other asset class performance, or the results, including, but not limited to, performance results, to be obtained by the Company, the Product, Product owners, or any other person or entity. PIMCO does not provide investment advice to the Company with respect to the Product, to the Product, or to Product owners. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index has any obligation to continue to provide the Index to the Company with respect to the Product. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index makes any representation regarding the Index, Index information, performance, annuities generally or the Product particularly. PIMCO disclaims all warranties, express or implied, including all warranties of merchantability or fitness for a particular purpose or use. PIMCO shall have no responsibility or liability with respect to the Product. The Index is comprised of a number of constituents, some of which are owned by entities other than PIMCO. The Index relies on a variety of publicly available data and information and licensable equity and fixed income sub-indices. All disclaimers referenced in herein relative to PIMCO also apply separately to those entities that are owners of the constituents of the PIMCO Index and to the Index Calculation Agent.

2. Assuming no withdrawals are made during the withdrawal charge period. Rider charges continue to be deducted regardless of whether interest is credited. Guarantees are dependent upon the claims-paying ability of the issuing company.

TC8028964(0625)3