Here are 3 compelling reasons why.

- There is more growth potential. With an FIA, you are not directly participating in any stock or equity investments. Instead, interest is credited based in-part on the change of a market index, such as the S&P 500. This means your plan participants have greater interest crediting potential in an up market, but never lose value in a down market due to market declines.1

- It provides downside protection. With increased market volatility, it’s critical to ensure your plan participants’ nest eggs are protected when the market index is down. FIAs are structured so that if the index is down, they may not earn any interest, but their cash value won’t decline due to market conditions. This means they will never earn less than 0%.

- An FIA can guarantee your plan participants with a stream of income during retirement, supplementing their pension and helping to close their retirement income gap. According to the Insured Retirement Institute, 95% of consumers are very or somewhat interested in owning an annuity that provides a guaranteed income each month.2

While the current low interest environment is great for mortgages and other debt consumers may hold, it can mean something different for your plan participants’ retirement nest eggs.

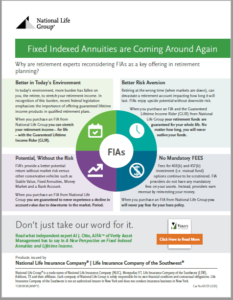

The combination of extremely low interest rates, increased market volatility and the growing need for lifetime income strategies has positioned Fixed Indexed Annuities (FIAs) as a growing player in the retirement plan toolbox. These market forces are leading astute plan sponsors and their advisors to include FIAs in their retirement plan offerings.

Take a look at these highlights or read the full Verity Asset Management White Paper on importance of having a diversified retirement plan by adding a FIA to your 403(b) or 457(b).

1Assuming no withdrawals during the withdrawal charge period. Rider charges continue to be deducted regardless of whether interest is credited.

2Why Most Consumers Want Guaranteed Lifetime Income, Financial Advisor, Feb. 25, 2020

“Standard & Poor’s®”, “S&P®”, “S&P 500®”, and “Standard & Poor’s 500™” are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. This Product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representations regarding the advisability of investing in the Product.

TC118695(1220)1