This Year National Tax Day is April 17.

Since 1955, for those living in the United States, Tax Day has typically fallen on April 15. This year April 15 falls on a Sunday and the following Monday is a federal holiday–Emancipation Day, the day in 1862 when President Lincoln freed the slaves in the nation’s capital. These two events push the tax deadline out to Tuesday, April 17.

Filing an Extension?

For those who need to file for an extension, they must file the request by April 17 and their taxes would be due on October 15, 2018. For those who live outside of the United States June 15, 2018, is Tax day; this is an automatic extension granted by the IRS.

Remember Retirement Contributions

Tax day is also the deadline for 2017 contributions to an individual retirement account (IRA).

Some Tax History Trivia

Prior to the Federal income tax, the federal government used regressive taxes to raise funds. It derived its revenue from tariffs on imports and exports. This put the burden mostly on the back of the middle class since they spend more of their income on day-to-day necessities. Ninety percent of the federal government’s revenue was derived from taxes on cigarettes and alcohol before the establishment of the income tax.

The 16th Amendment to the Constitution established Congress’s right to impose a Federal Income tax. Passed by Congress on July 2, 1909, and ratified February 3, 1913. The first Tax Day was March 1, 1914. The Bureau of Internal Revenue created Form 1040 to file and pay personal income tax, which was one percent for income under $3,000 and up to six percent for the wealthiest Americans. The tax rates for 2017 range from 10% to 39.6%.

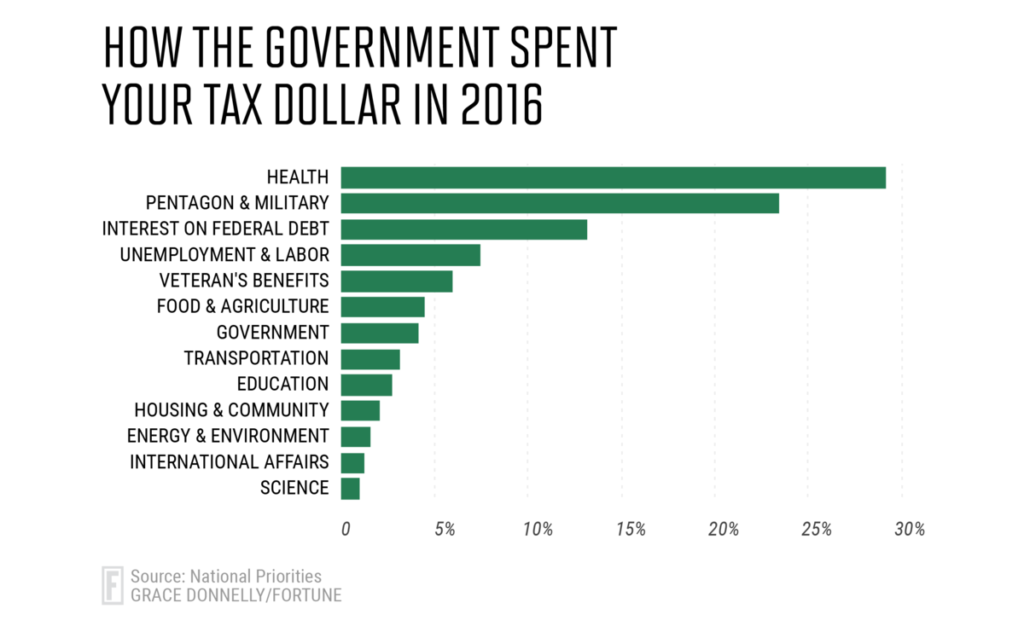

See how your tax dollars are spent

While tax day may bring mixed emotions for many, it’s an opportunity to encourage your employees to reflect on their financial picture and plan ahead for next year. Contact your National Life Group representative for educational resources on retirement planning.

TC100578(0418)1