There are over 1,500 “national days”, but did you know that July 17th is National Lottery Day?

Here is a quick history lesson about gambling and what you should consider so that it doesn’t impact your retirement dreams.

According to the National Day Calendar, the Massachusetts State Lottery founded National Lottery Day in 2018 to provide consumers with a day of special promotions for lottery products. Massachusetts State sold their first lottery ticket in 1972. It has been an essential source of unrestricted local aid in the Commonwealth. Historically, lotteries date back to the 15th century. While early lotteries funded village needs, they also were vital to strengthening defenses. Money raised would also feed and clothe the poor. According to Random Riches author, Manfred Zollinger, one of the oldest lotteries dates back to 1441 in Bruges, Belgium. In early lotteries, merchants paid for the chance to win money and prizes. In the United States, early lotteries paid for cannons during the American Revolution. They also raised money to pave the roads up and down the east coast of the United States. Today, lotteries are state-owned and operated. The funds that are raised support government programs, education systems, and the communities those lotteries serve.

While gambling is a staple in many countries including the United States, it’s not the way you should approach retirement. At National Life Group, we believe “Zero is Your Hero.” What does that mean? When saving for retirement you should never lose a penny of your hard-earned savings! You work to feed and care for your family, and the last thing that you should have to worry about is whether your retirement savings is being gambled away in risky investment options. Remember, when you gamble on the lottery there is a one in a million chance (or worse!) that you could win. Gambling is not the recommended way to approach retirement!

Here are a few things to consider when weighing the cost of gambling versus saving for retirement.

| Why Save for Retirement? | Why Avoid Gambling? |

| Prepares your family for the future. | Likely to lead your family into debt. |

| Prepares you financially for your retirement. | Could destroy you financially, now and in retirement. |

| Let’s you imagine the future you want & deserve! | Puts your future goals & aspirations on hold! |

| The probability of your being prepared is greater. | The probability of you winning is low. |

| Prepares you should you live too long, die to soon, or become ill. | Reduces the money needed should you live too long, die to soon, or become ill. |

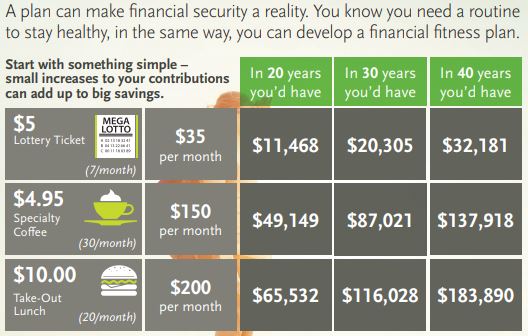

Whether it’s $1 or $100, chances are you’re better off paying yourself first by saving in your company sponsored 403(b) or 457 plan, than you are gambling it. If you start saving today or increase your retirement contributions today, you are increasing your odds to be prepared for retirement.

Instead of gambling today consider an increasing your retirement plan contributions. It is a great way to give your retirement a boost without gambling.

All figures assume a 3% annual rate of return compounded monthly and do not include any matching contributions made by an employer which are available in some qualified retirement plans. This is a hypothetical example for illustrative purposes only. The guarantees of fixed insurance products in a retirement plan are dependent upon the claims paying ability of the issuing insurance company.

TC115690(0720)1